Fiscal Responsibility

Allen ISD can fund all of the 2024 Bond projects using the existing tax rate

Allen ISD has a proven track record of finishing bond projects on time and on budget. The District accomplished this with the 2020 Bond Projects and would apply the same approach to the 2024 Bond.

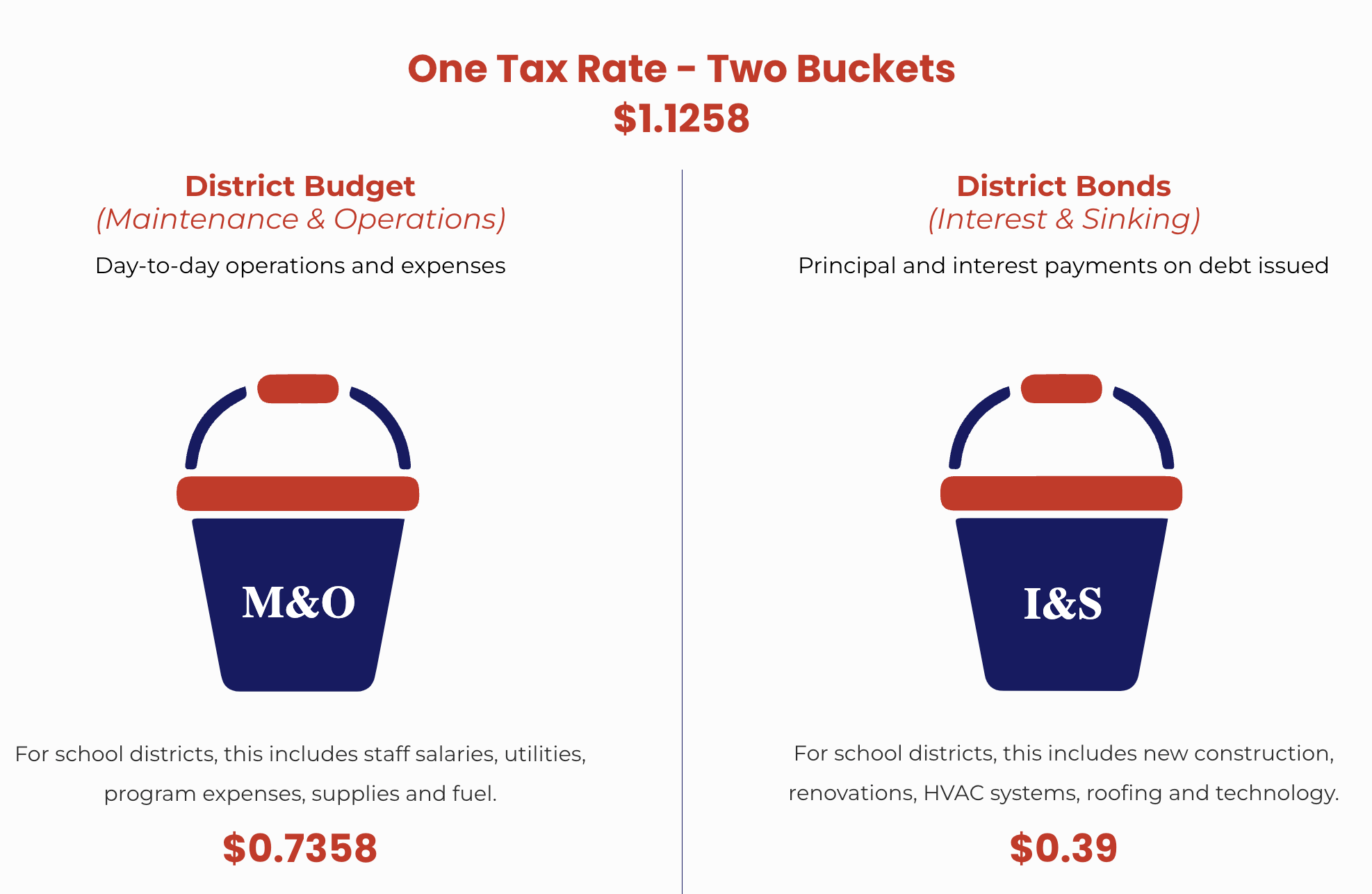

Most of the funding for Allen ISD schools -- about 80 percent -- comes from local property taxes. This means the bulk of the responsibility for funding Allen ISD schools comes from local residential and commercial taxpayers. Only 19 percent of the district’s resources actually come from state funding, and 1 percent comes from federal funding. These funds make up the district budget - day-to-day operations and expenses.

However, school bonds are necessary to provide long-term financing for a variety of purposes. For example, they may finance facility renovations and construction or purchase capital equipment, such as technology, vehicles, and buses. As shown below, district bond (interest and sinking) and the district budget (maintenance and operations) funding come from two different sources -- or buckets -- and can't be mixed. In other words, district budget money can't be used to build a school, and bond funds can't be used to pay teacher salaries. That's why when it comes time to make major capital improvements, the school district seeks voter approval.

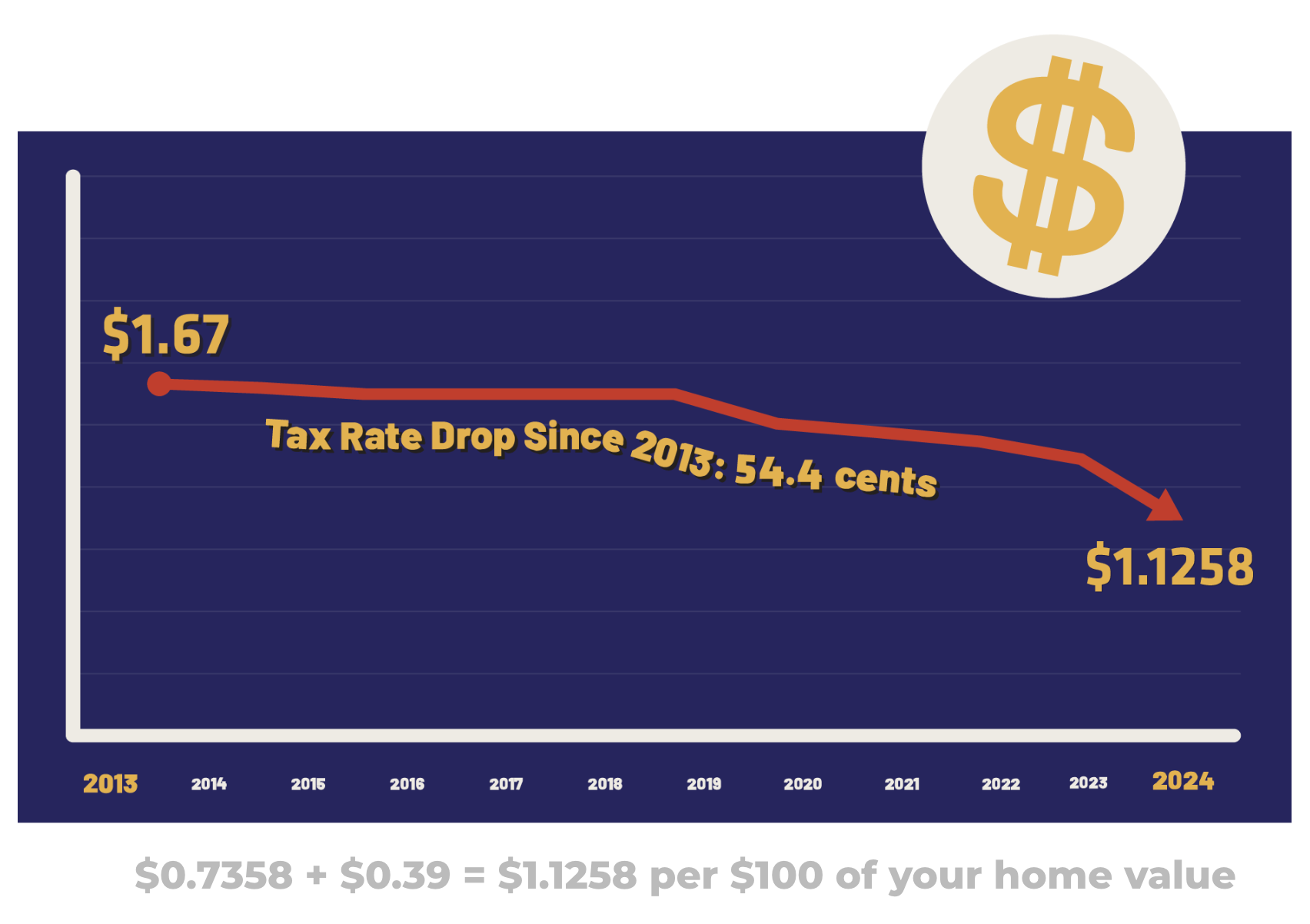

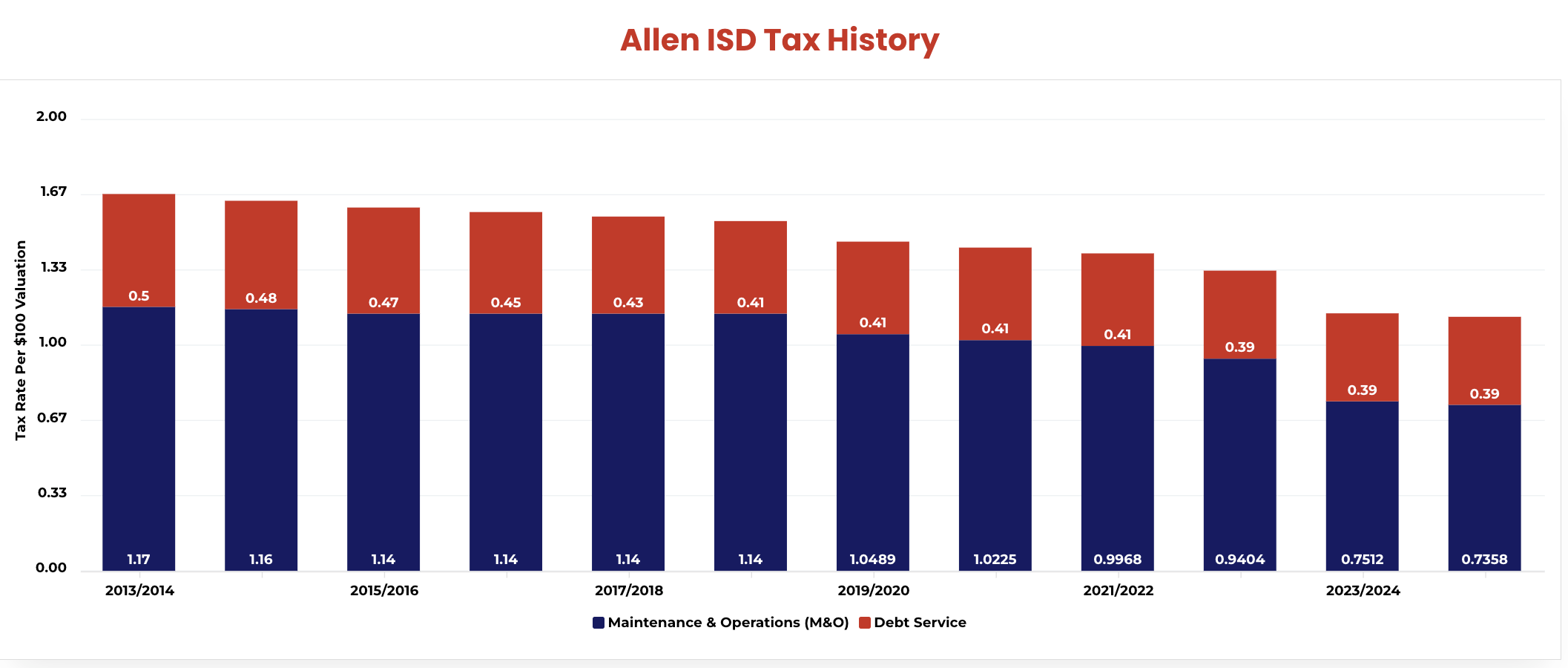

Allen ISD can fund all of the 2024 Bond Projects using the existing tax rate. The charts below show how the total tax rate has declined over the years.